The Best Guide To Final Expense In Toccoa Ga

Wiki Article

How Final Expense In Toccoa Ga can Save You Time, Stress, and Money.

Table of Contents5 Easy Facts About Affordable Care Act Aca In Toccoa Ga ShownMore About Commercial Insurance In Toccoa GaThe Annuities In Toccoa Ga StatementsSome Known Questions About Annuities In Toccoa Ga.

A monetary advisor can likewise help you choose exactly how best to achieve goals like conserving for your youngster's university education and learning or paying off your financial debt. Although monetary experts are not as fluent in tax legislation as an accountant might be, they can supply some guidance in the tax obligation preparation process.Some financial advisors provide estate preparation services to their customers. They could be learnt estate planning, or they might wish to deal with your estate attorney to address questions about life insurance, trusts and what need to be finished with your financial investments after you pass away. Lastly, it is essential for monetary advisors to remain up to day with the marketplace, financial conditions and advising best methods.

To sell investment items, experts should pass the pertinent Financial Industry Regulatory Authority-administered examinations such as the SIE or Series 6 tests to acquire their accreditation. Advisors who desire to offer annuities or various other insurance policy products must have a state insurance permit in the state in which they prepare to market them.

Health Insurance In Toccoa Ga Fundamentals Explained

Allow's state you have $5 million in properties to manage. You employ an advisor who bills you 0. 50% of AUM per year to help you. This implies that the expert will receive $25,000 a year in costs for managing your financial investments. As a result of the normal charge framework, several advisors will not collaborate with customers that have under $1 million in assets to be managed.Investors with smaller portfolios could look for a financial consultant that charges a per hour fee rather than a portion of AUM. Per hour costs for advisors normally run in between $200 and $400 an hour. The even more facility your economic situation is, the more time your consultant will certainly have to devote to managing your possessions, making it much more costly.

Advisors are skilled specialists that can assist you establish a prepare for financial success and implement it. You could additionally take into consideration connecting to an expert if your individual monetary scenarios have just recently ended up being much more complicated. This might mean getting a residence, obtaining married, having children or obtaining a large inheritance.

Some Ideas on Medicare Medicaid In Toccoa Ga You Should Know

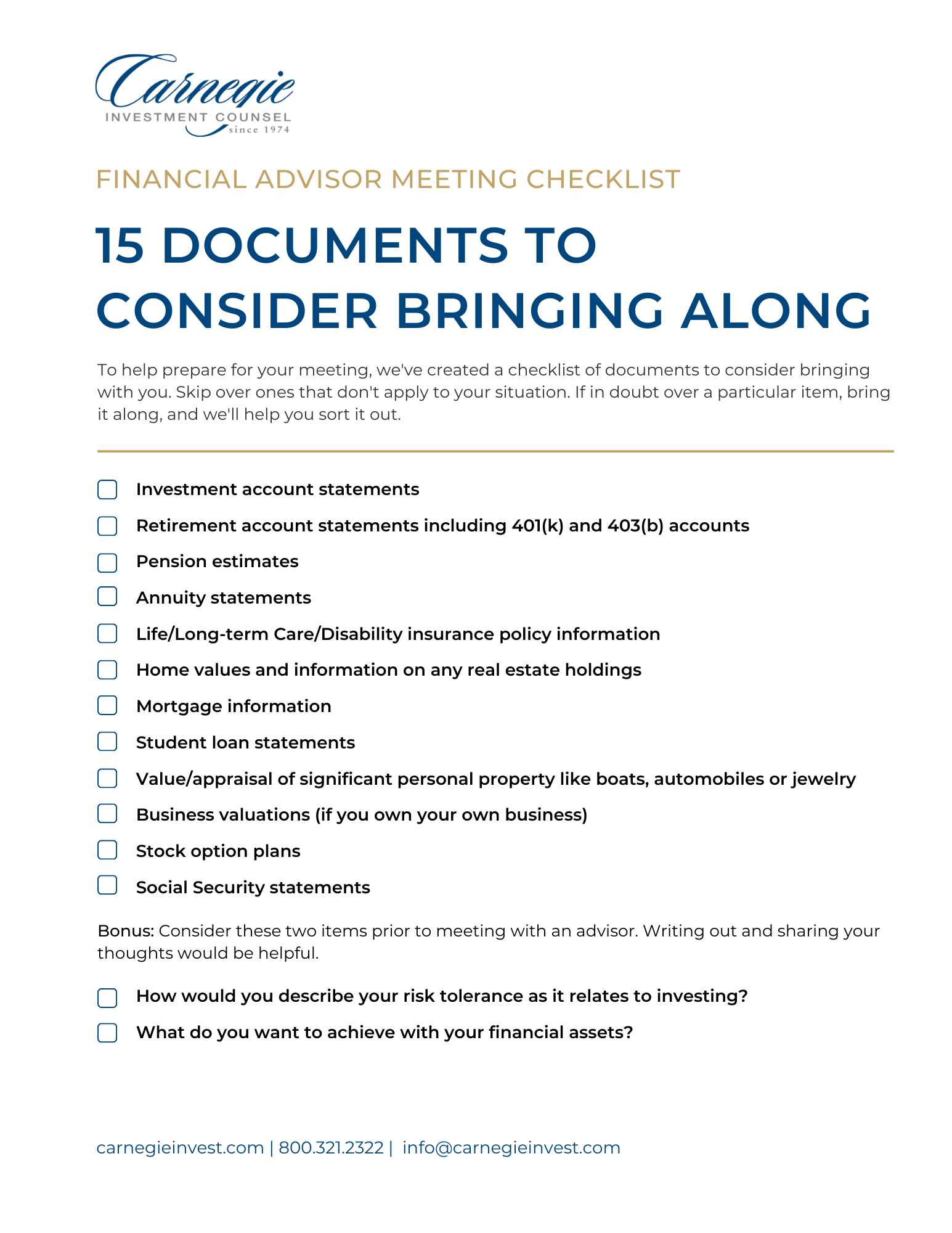

Before you meet the consultant for a preliminary appointment, consider what solutions are essential to you. Older grownups might require assistance with retirement preparation, while more youthful grownups (Annuities in Toccoa, GA) might be looking for the most effective way to spend an inheritance or starting a service. You'll wish to look for an expert who has experience with the services you desire.What business were you in prior to you obtained into financial encouraging? Will I be working with you straight or with an associate advisor? You might likewise want to look at some example financial strategies from the consultant.

If all the examples you're supplied coincide or comparable, it image source may be an indication that this advisor does not correctly tailor their suggestions for every customer. There are three main kinds of monetary suggesting professionals: Qualified Financial Coordinator professionals, Chartered Financial Analysts and Personal Financial Specialists - http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1891. The Qualified Financial Planner specialist (CFP professional) qualification shows that an advisor has satisfied a specialist and moral criterion set by the CFP Board

An Unbiased View of Affordable Care Act Aca In Toccoa Ga

When picking an economic consultant, take into consideration someone with an expert credential like a CFP or CFA - https://lwccareers.lindsey.edu/profiles/3840718-jim-thomas. You might likewise take into consideration an advisor who has experience in the solutions that are crucial to youThese advisors are usually riddled with disputes of passion they're extra salesmen than consultants. That's why it's vital that you have an advisor that functions only in your benefit. If you're seeking an expert that can truly supply genuine worth to you, it is necessary to investigate a number of possible choices, not simply choose the given name that markets to you.

Presently, numerous experts have to act in your "best passion," however what that requires can be nearly unenforceable, other than in the most egregious cases. You'll need to locate a real fiduciary.

0, which was passed at the end of 2022. "They ought to prove it to you by showing they have actually taken serious ongoing training in retirement tax and estate preparation," he claims. "In my over 40 years of practice, I have seen expensive irreversible tax blunders due to ignorance of the tax obligation rules, and it is regrettably still a big issue." "You need to not spend with any kind of advisor who doesn't spend in their education.

Report this wiki page